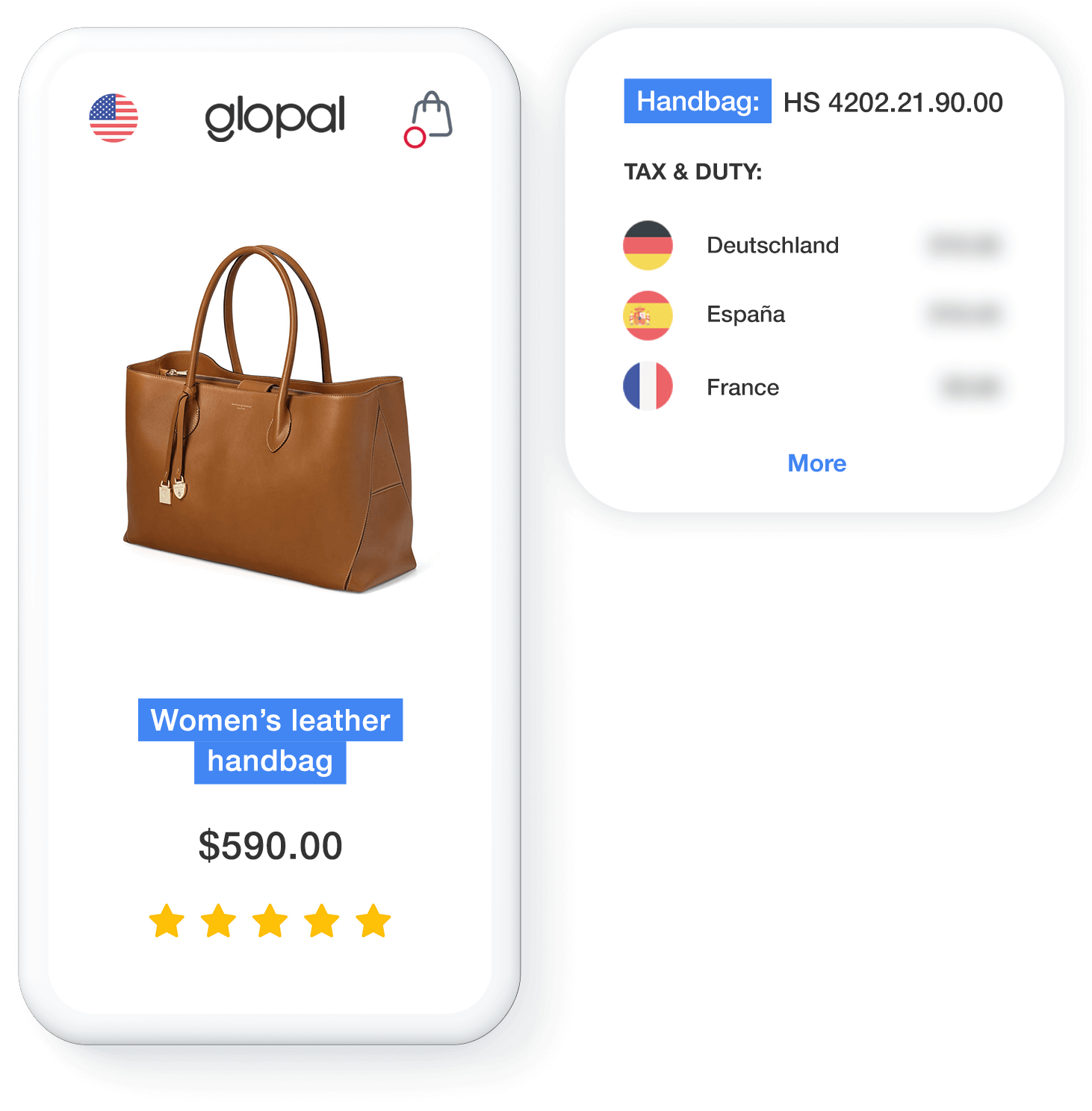

A simple and highly scalable integrated & automated HS Product Classification tool for large and enterprise ecommerce merchants.

Customs compliance is a major pain point for international retailers. A single shift or reclassification in HS codes can impact a retailer’s ability to clear customs or properly collect Total Landed Cost. On-The-Fly Classification (OTFC) ensures retailers are up to date and compliant, a task once unobtainable when manually processed.

OTFC detects and classifies product catalogues in real-time. Retailers enjoy unprecedented accuracy, agility and scalability to HS code classification for both fixed or dynamic product catalogues. OTFC mitigates risk for sellers and buyers by utilizing a complex context-based algorithm that matches data points and language patterns to the correct HS classifications.

The traditional process of manually classifying product catalogues is tedious and costly. Now with OTFC, retailers can seamlessly assign HS codes to new product catalogues and update existing catalogues in real-time. OTFC provides retailers peace of mind knowing their product categories are always up to date.

OTFC ensures retailers:

OTFC ensures customers: