Glopal is an integrated full-stack cross-border eCommerce solution that enables online merchants to provide international customers with an end-to-end localized shopping experience. Our solutions cover international marketing, localized store and checkout, customs classification, calculation and documentation and international shipping and returns.

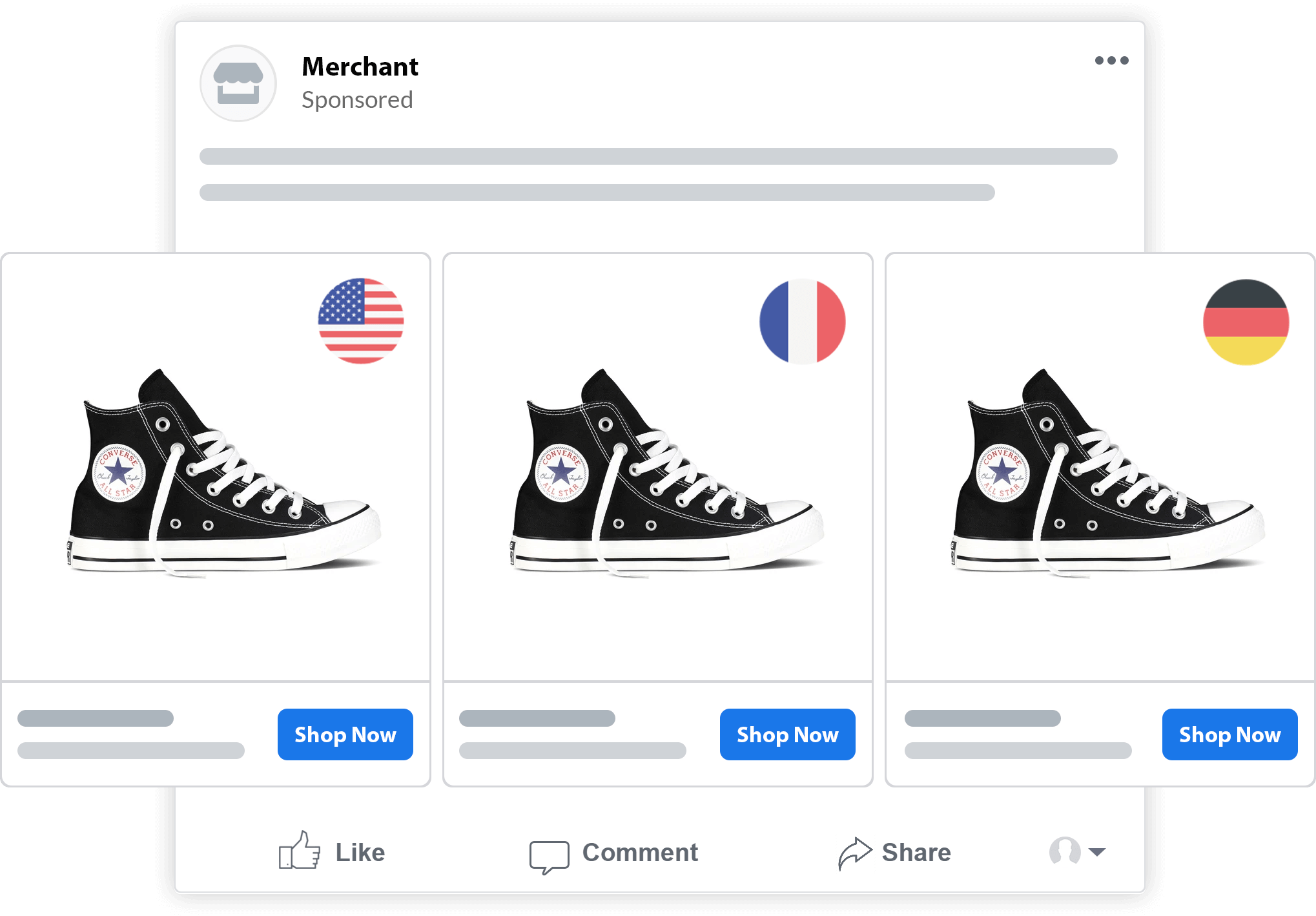

A simple & fully automated ecommerce solution that connects your existing Facebook or Instagram ads with international buyers worldwide, growing your sales instantly.

Global uses a natural language processing solution to deliver affordable, automated human-quality translation, but localizing an online store goes far beyond just translation. It involves converting currencies, sizes, payment methods and much more.

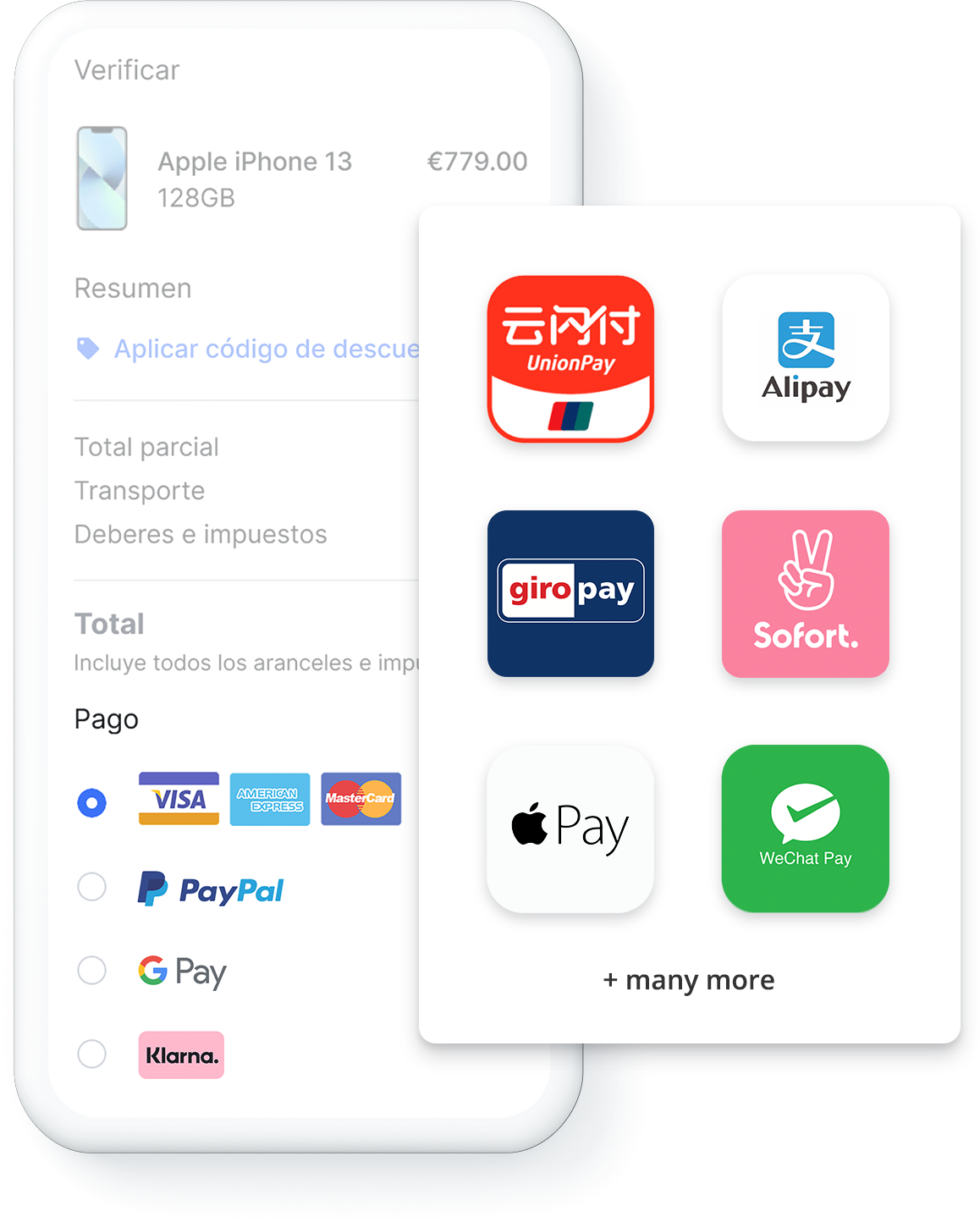

The checkout is the very final step of the buying process, changes made here can have a huge impact on your overall store performance. Localizing your checkout will boost your international conversion rate and revenues.

Our suite of tax & duties and returns solutions is designed for enterprise ecommerce businesses who want to accelerate worldwide sales.

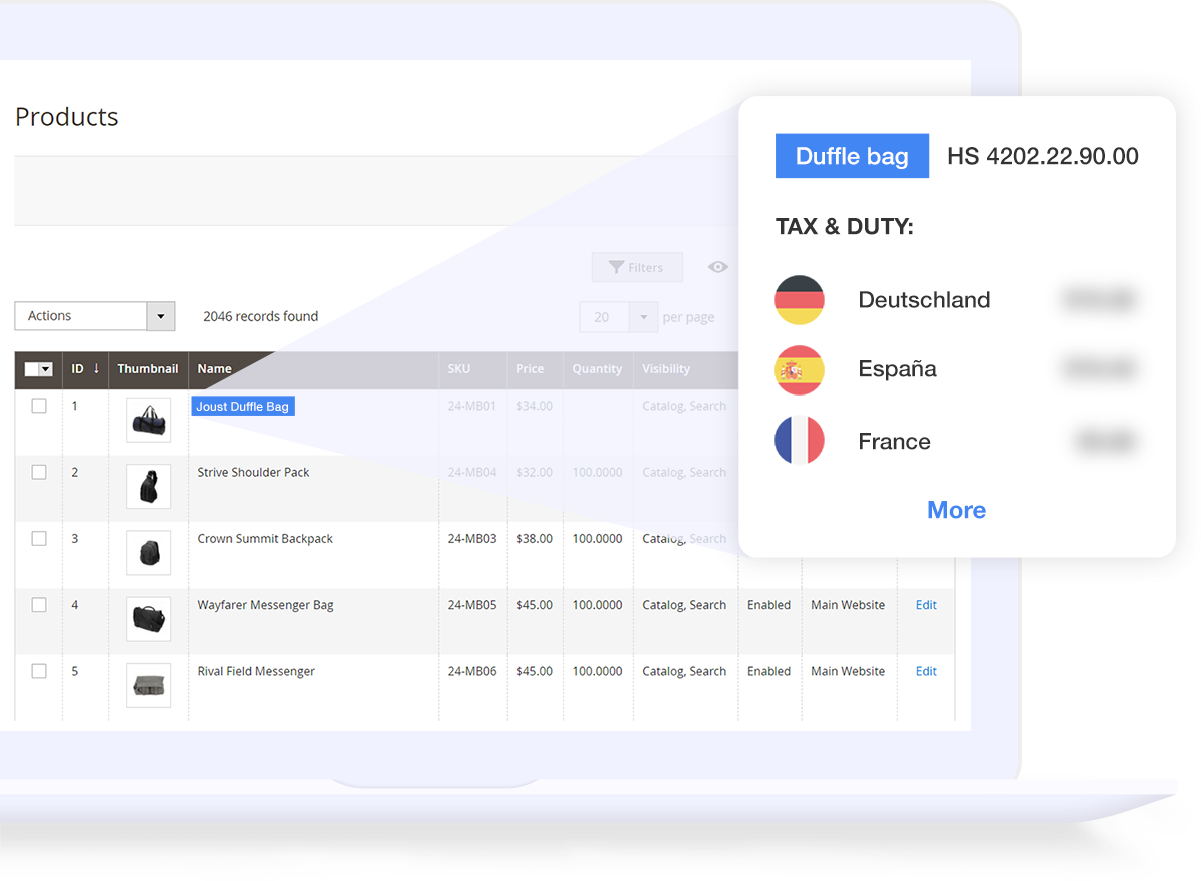

Customs compliance is a major pain point for international retailers. A single shift or reclassification in HS codes can impact a retailer’s ability to clear customs or properly collect Total Landed Cost. On-The-Fly Classification (OTFC) ensures retailers are up to date and compliant, a task once unobtainable when manually processed.

International import and export restrictions are constantly changing. Glopal offers a prohibited items check that automatically identifies restricted and prohibited items for export to specific destinations and informs the buyer in order to prevent delayed or failed shipments.

International transactions don’t end when a customer receives their order. When returns are necessary, Glopal's global returns solution ensures a streamlined system that is both easy for customers to navigate and affordable for merchants to manage.

Are you confused by how customs taxes and duties work? Without getting into all the terminologies and legal complexities, we'll summarize the essentials and explain how Glopal handles it for you.

When shipping internationally, packages are charge based on volumetric or actual weight.

Some countries and territories allow goods below specific values to be imported free from duty and/or taxes.

All imported goods and their values must by law be declared to the importing country's customs office.