Brexit is currently going through a transitional period until 31 December 2020, where during this time nothing will change and the UK will continue to comply with all EU laws and rules. After this transitional period, there may be a series of significant changes for merchants selling into the EU as the UK negotiates an entirely new relationship with the EU.

We have put together an article explaining what changes are happening for UK merchants selling into the EU, merchants selling into the UK and how you can prepare for January 1st.

Key summary of what needs to be done:

|

UK merchants |

|

| EU / US merchants |

|

All changes must be implemented before January 1st to be able to sell into the EU or UK without restrictions.

Whilst there isn't much time to implement these important changes, Glopal is here to help. We can guide you through the changes and automate the process to ensure you are ready to sell into the EU (or the UK for EU/US merchants) in time for brexit.

Get in touch and be brexit ready today.

What happens from 1st January?

The United Kingdom will no longer be a part of the European Union on the 1st January 2021. From that point onwards the UK will be considered separated from the EU and will no longer be subject to regulations given by the EU.

What this also means is that the UK no longer benefits from the positive trade aspects of the EU’s trade agreements, and must negotiate their own. If it doesn’t manage to negotiate a trade agreement by December 31st, then UK merchants may be subject to a host of rule changes and tariffs as it falls out of the EU single market and customs union.

As of now, there is no trade agreement in place between the UK and the EU so there are some uncertainties that lie ahead. However there are things that can be implemented now to ensure you can continue (or begin) selling internationally into EU countries once the UK has left.

Let’s explore what changes may affect UK merchants selling into the EU, and EU merchants selling into the UK.

Changes for UK merchants selling into the EU

There are changes you need to be aware of and plan for before January 1st to both VAT and customs.

The changes to international VAT for UK merchants

From January 1st, the UK will no longer be a part of the EU VAT regime and customs union, and products imported/exported will require import VAT and potentially customs duties depending on the product/packages being delivered.

Domestic VAT itself will not apply to orders to the EU and is set to remain the same after the transitional period.

However as a UK merchant, selling into the EU will be treated the same as selling outside of the EU, and VAT will no longer be the simplified process we know today, and will unfortunately change depending on the markets you sell into, the cost and type of goods you sell as well.

If you don’t tackle these VAT changes, there’s a very high chance that your goods may be blocked by customs, your customers won’t receive a positive buyer experience and you may lose repeat business.

1. Register local VAT for each international marketUK merchants are able to use their UK VAT number to sell into EU markets, until a certain sales threshold was hit for that particular country, i.e 100,000 euros for Germany. Once this threshold is hit, the merchant is then required to get a EU VAT number to continue selling. Whilst this remains the same, the process itself to register for an EU VAT number will become more complex and so for merchants who want to trade above this threshold in 2021, it is worth registering for those markets now as the process can take up to a few weeks.

2. Appoint a local fiscal representative

A fiscal representative is a local representative of the company, who registers local VAT on behalf of the merchant, managing with queries and filing obligations of the company for dealings with the tax authorities. They also may be liable for the VAT liability of the company. Some countries require all non-EU companies to appoint a Fiscal Representative when registering for VAT, which in addition may be needed at the moment of importing goods to clear them through customs. Countries such as France, Italy, Spain all require this, however Germany does not.

For merchants selling into the UK, HMRC does not require this, you just need a local UK VAT registration.

3. Protect your customers from import VAT stingsFor the first time, there will be an import VAT for all goods imported into the EU. For a short time, the EU will allow a VAT exemption for parcels below 22 euros, however for all parcels above that value there will be an import VAT due. By making sure this is correctly handled through the local VAT registration and VAT return, your customers won’t receive a nasty VAT surprise when their parcel goes through customs.

The changes to international customs for UK merchants

There are some impacting changes to how customs will work for UK merchants selling into the EU markets. We have outlined what you need to do before January 1st to be able to sell without any problems into your markets, as well as ensuring your customers maintain a positive buyer experience.

1. Apply for an EU EORIIf you currently sell internationally, you should already have a UK EORI number. These are special identification numbers given by the tax & customs authorities to import internationally.

Example of EORI number

Once the UK has left the EU, the first thing merchants will need to do is apply for a new EORI number for the EU to ensure goods are picked up for delivery and cleared for your target market.

2. Prepare customs declarationsYou’ve made the sale and the goods are ready to ship, the next thing you need to prepare is customs declarations. The good news is that they’re largely standardized across the EU, they include all the information the target country would want to know about the goods you’re transporting, such as who your business is, what the goods are classified as, how they are being shipped, who is responsible for the customs, etc.

This can be automated once you’re registered with the local tax authorities of each market, but it’s advisable to get professional help when doing it for the first time as any errors may lead to undelivered goods and/or a very bad customer experience.

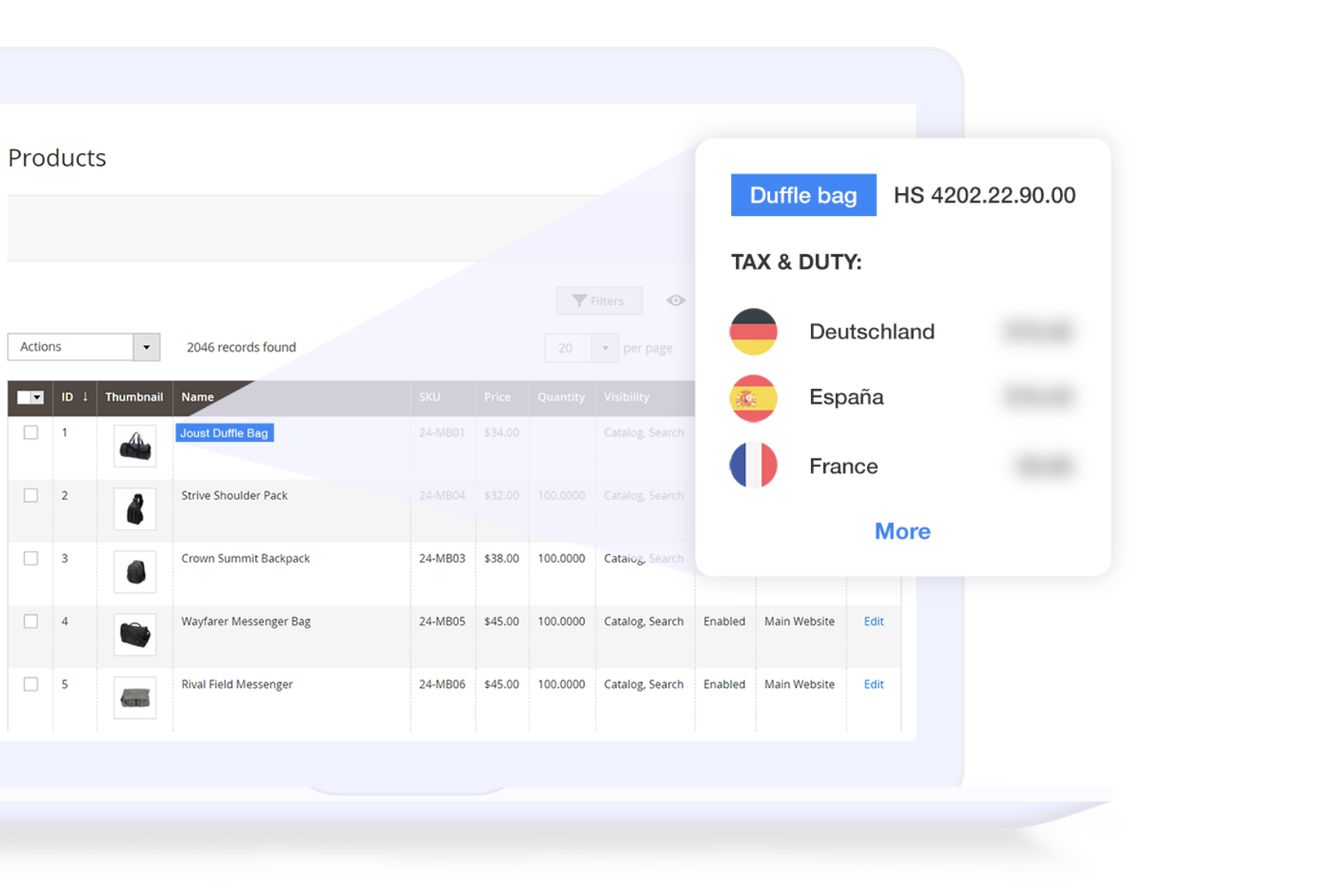

3. Determine the correct HS classifications for your productsOne of the key requirements for customs declarations are commodity codes to help customs identify what your products are. Harmonized System (HS) values are used to classify products for customs import duty and tax through the application of codes to each product you transport.

Countries want to know what your products are but this also helps to charge the correct tariffs and ensure you don’t overpay for importing products. These numbers help to determine what your products are, the materials they’re made from and it’s very important to do this. If you have a wide variety of products, it can become quite laborious to classify all products and keep up to date with the codes, however Glopal does provide an automated service that classifies all existing and new products, giving you ease of mind.

4. Factor in Tariffs for your selling costsCurrently there is no trade agreement in place with the EU. This means that If you’re shipping into the EU, WTO rules dictate each nation must charge it’s standard tariff rates for selling products into those markets. This is something to bear in mind if you want to absorb these costs into product prices, or if you want to add this into the checkout as an additional cost if you want to pass this onto your customer.

How does this affect international shipping for UK merchants?

All of the above changes may subsequently affect international shipping into the EU. One of the biggest changes will be implementing customs declaration into your delivery process, which allows your parcel to pass through borders. This follows a very similar process for those merchants who already sell internationally outside of the EU.

However there are some other factors to consider when shipping into the EU.

- Incoterms

For merchants who have sold outside of the EU, you may already be aware of Incoterms. Incoterms (International Commercial Terms) are a set of standardised international arrangements for shipping your goods. They act as a contract between merchants and their buyers and include all risks and costs associated with the transactions of goods. These will be required for merchants shipping into the EU.

It’s important to choose which Incoterm(s) you will use for which products and to which countries before you start to ship internationally. Incoterms are used to:

- State who is responsible for the cost of the shipment, insurance, import and customs costs of the shipment.

- Determine who is responsible for the transport and where to.

- Allocate when the risk and costs of delivery pass from seller to buyer.

- Returns policy

Currently the EU law protects its citizens’ rights to return a product within 14 days of purchase. However once the UK leaves, this will no longer be mandatory. It will be up to you whether you offer this service to your customers or not. However to improve buyer experience and satisfaction, we suggest continuing with a returns policy as part of your shipping strategy.

Following the changes, returns may be a little bit more complicated than previously, however we strongly suggest partnering with a company who can offer an international returns solution can help to create an easy and hassle-free returns process. If you do choose to continue with a returns process, it’s important to communicate clearly and update your returns policy.

Another big change will be implementing customs declaration into your delivery process, which allows your parcel to pass through borders. This follows a very similar process for those merchants who already sell internationally outside of the EU.

To recap, you need the following to ensure good delivery practises into the EU:

- EU EORI number

- Completed commercial invoice (customs forms)

- HS classification on all products

- Incoterms

- Customs & shipping costs displayed for your customers

- Returns policy

With all of the changes, it’s important to formulate a strong delivery strategy so your products may be able to be delivered across borders without any challenges.

Changes for EU/US merchants selling into the UK

To ensure fair measures for UK merchants, the UK government will be implementing changes for any merchant outside of Britain who sells across the border into the UK. This is to go inline with the changes the EU have implemented .

VAT changes for selling into the UK

From January 1st, the UK government will implement additional changes themselves by introducing a new VAT for treatment of goods arriving into Great Britain from outside of the UK.

This will ensure that goods from EU and non-EU countries are treated in the same way and that UK businesses are not disadvantaged by competition from VAT free imports. It will also improve the effectiveness of VAT collection on imported goods and address the problem of overseas sellers failing to pay the right amount of VAT on sales of goods that are already in the UK at the point of sale.

This change will affect all international merchants selling into the UK.

- B2C parcels under £135

For any parcels under or at the value of £135, rather than paying import VAT at UK customs, merchants are going to have to charge their customers the UK VAT value in the checkout. This will then need to be declared through the UK VAT return.

For any EU, US or other international market merchants selling into the UK, they are going to need to get registered for UK VAT to sell into Britain, prepare customs declarations in a similar fashion as we have mentioned already for UK merchants.

For those merchants who selling into the UK, you can register for UK VAT here

- B2C parcels over £135

For parcels over the value of £135, the usual charges will apply. For goods imported into the UK, they have to account for import VAT as well as customs delcarations. And as of 1 January 2021 this will include the countries within the EU.

How to prepare for January 1st

There are a lot of changes that will be implemented for both UK merchants and EU merchants selling into the UK, from the 1st January and transitioning through these changes can appear difficult and very time consuming.

One of the most important things that you need to consider is to ensure that transitioning through these changes doesn’t affect the buyer experience of your customers.

- Determine your markets - With all the changes, it’s now more important than ever to discover the markets you want to sell into so you can get all the necessary registrations completed.

- Register for all necessary VAT and EORI - You will need to register for the necessary VAT in each market you want to sell into, as well as setting up an EU EORI. The process could take up to a couple of weeks so it’s a good idea to begin now rather than wait.

- Correct Product classification - Your products need to be classified with HS codes correctly to avoid any customs and delivery issues, as well as VAT problems. Not only is getting parcels stuck in customs going to give a negative experience to your customer, but risking fines for incorrect VAT payments further down the line isn’t nice and can be avoided.

- Implementing Tax and Duties - Ensuring all customs tax and duties are correct is also incredibly important for your customers. Being able to display the VAT at checkout rather than have them face surprise VAT stings is going to improve their buyer experience and the likelihood of them returning for repeat purchases. Don’t run the risk of upsetting customers - implement the correct tax and duties at your checkout.

- Shipping - Having a correct shipping strategy and solutions in place is necessary to prevent friction for you and your buyer as well as being able to deliver into all of your chosen markets. This includes adding the additional requirements into your shipping process, i.e How will duties be handled? will they be collected on delivery? And how is this cost reflected to your buyers? Also how will you share necessary data with respective carriers such as HS codes and customs declarations? There are a lot of fundamental components to integrate into your shipping process.

This can seem like a daunting checklist to work through, especially with such little time left. However working with an ecommerce partner can help not only speed up the process but also make it as simple and easy as possible for you.

This is where Glopal can help.

We manage every step in the global ecommerce process from discovering international markets and international buyers for your products, automatic HS product classification, tax & duty calculation, through to customs documentation and shipping label generation and returns.

Our tailored ecommerce solution is designed to manage your entire international process through the Brexit transition and enable you to sell into any EU market hassle-free from January 1st.

We can help you to launch into the EU post brexit:

- Identify top EU markets for your products

- The solution localises the product feeds into over 25 currencies, providing buyers with the same local experience they’d expect.

- Glopal’s guaranteed total landed cost reduces international delivery times and includes all customs duty and tax. Glopal's ‘Delivery Duty Paid’ solution integrates seamlessly with your existing checkout.

- Glopal’s automated HS classification and customs declaration enables you to classify all your products and keep up to date. It offers a prohibited items check that automatically identifies restricted and prohibited items for export to specific destinations and informs the buyer in order to prevent delayed or failed shipments. This verification can also be performed offline and full product catalogs can be processed via our API.

- Glopal’s international shipping creates a seamless and simple process, enabling merchants to ship their products overseas at a cost effective & competitive rate, whilst also providing a streamlined, hassle-free returns option.

To get your store ready for Brexit’s changes, get in touch with one of our ecommerce experts today.