Localized Checkout

& Payments

Support familiar local payment methods and convert more international buyers, all with fraud protection and a lower cost per transaction.

Increase international authorization

Enabling international buyers to transact payments using a familiar local payment method is essential for buyer conversion. Local acquiring where merchants process their payments with acquiring banks in the same market as the cardholder further improve acceptance rate. Glopal enables merchants to support local payment methods with local acquiring tailored to each international market within which they trade. Merchants can enable multiple local payment methods through one account with Glopal with one simple, low transaction fee.

![]()

Localization

Create a fully translated and localized checkout experience for your international buyers.

Methods

Increase international payment authorization by supporting familiar local payment methods.

Checkout

Localization

The checkout is the very final step in the buying process, improvements made here can have a significant, disproportionate and compound impact on the rest of your buying funnel. Glopal enables merchants to provide international buyers with a completely localized checkout experience, in local language, currency and with local payment and shipping options. This is essential for international buyer confidence and conversion.

Local Payment Methods

Glopal enables merchants to support local payment methods tailored to each international market within which they trade. Merchants can enable multiple local payment methods through one account with Glopal with one simple, low transaction fee.Debit and Credit cards

Debit and Credit cards

Debit and Credit cards

Debit and Credit cards

Debit and Credit cards

Debit and Credit cards

Debit and Credit cards

payments

payments

payments

wallet

wallet

wallet

methods

methods

... and more

Along with supporting local payment methods across the majority of the world's major consumer markets, Glopal also enables many merchants to reduce their international transaction fees by over 50%. When merchants add up the fixed fee, the transaction fee, the origin fee and the currency exchange fee of international orders many discover their payment processors are charging them rates that can add up to as much as 9% per transaction. Glopal offers merchant’s one simple and affordable international transaction fee across all markets.

Currency & fraud

protection

Glopal takes on the risk to protect merchants from chargebacks, fraud and currency fluctuations. Glopal payments ensure better fraud prevention by setting up different security rules per country, enabling risk to be managed across all international markets. Glopal also protects you from international exchange rate currency fluctuations. By providing fixed currency costs, you can ensure that what your buyer pays, you receive. This also includes customer refunds - if a customer refund is requested after a period of time, we will use the same exchange rate as was used when the order was placed.

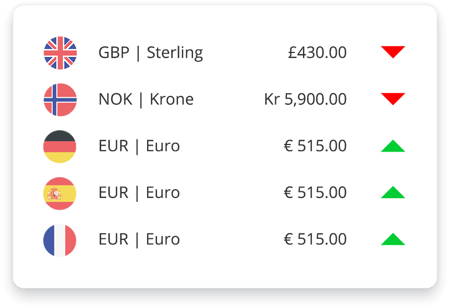

Currency Conversion

Glopal converts all product prices to buyers’ local currency (based on current exchange rates) and enables merchants to transact payment in up to 25 currencies. Glopal also protects you from international exchange rate currency fluctuations. By providing fixed currency costs, you can ensure that what your buyer pays, you receive.

Price adjustment

& rounding

Directly converting product prices can sometimes lead to strange and ugly decimal price points. Glopal gives merchants the tools to set price rounding rules to ensure international pricing looks local.

Increase conversion

rate by 31%

International traffic directed to an appropriate localized store will have on average a 31% higher conversion rate than international traffic directed to a non localized store.

Become a

global brand

Book a product demo today to explore our suite of cross-border tools and to learn more about how Glopal can grow your international sales.