Changes for UK merchants when selling into Europe

VAT

All orders above €22 will be subject to VAT

Customs Duty

All orders over €150 are subject to customs duties

Customs Clearance

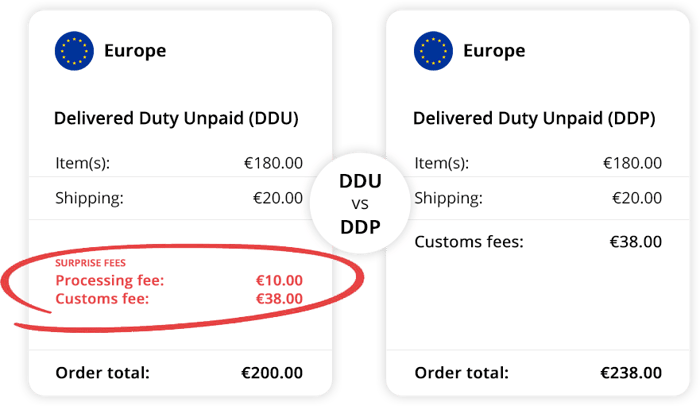

All UK orders imported into the EU will have to go through Customs Clearance and merchants will need to decide whether to adopt a DDU (Delivered Duty Paid) or DDP (Delivered Duty Paid)

Changes for US/EU merchants when selling into UK

VAT

All merchants must register for UK VAT

Customs Duty

All orders over £130 are subject to customs duties

Customs Clearance

All US/EU orders imported into the EK will have to go through Customs Clearance and merchants will need to decide whether to adopt a DDU (Delivered Duty Paid) or DDP (Delivered Duty Paid)

For all merchants selling into Europe there are big changes are on their way from the 1 July 2021 to the way that VAT is charged and collected.

Changes going forward:

A value-added tax (VAT), in some countries also known as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer.

For all countries outside of Europe, all orders above €22 are subject to VAT, the VAT rate will depend upon the European country into which the item is been imported. Rates are between 17-27% and will be charged at the point of import (until 1st July 2021, when this will change).

The key difference between taxes and duties is that duties are a type of tax on goods entering or leaving a country, while taxes are charges placed on almost all purchases. Both contribute to the total import and export costs of a product.

For countries outside of Europe, all orders over €150 are subject to customs tax and duties when entering Europe.

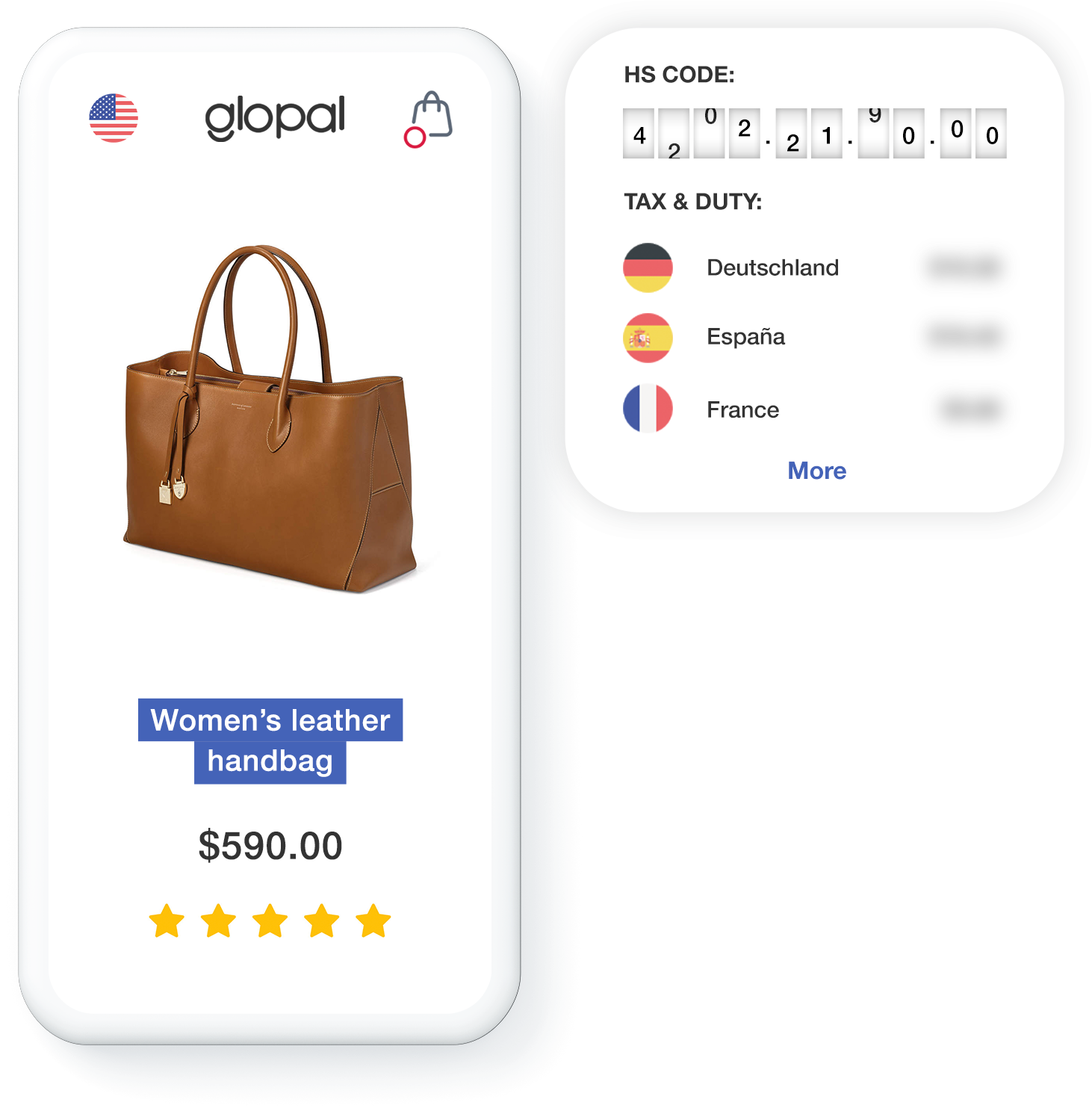

In order calculate the tax and duties for a given item, the item must be classified under the Harmonized System (HS).

The country of origin refers to the country of manufacture, production, or growth where a product or article comes from. Simply shipping a product through another country does not change the origin.

When importing items into Europe the item's country of origin is important. Depending upon the item’s country of origin different levels of tariffs may be applied.

Items with a British Country of Origin, for example, are not subject to customs duty when being imported into Europe.

In order to provide the best customer experience to European buyers, merchants should aim to remove as much friction and stress from the import process as possible. Merchants should consider it their responsibility to ensure that Customs Clearance, Tax & Duty and VAT is handled as smoothly as possible

In order to take responsibility as a merchant and provide the best buyer experience you will need to:

Harmonized System (HS) code classification

The Harmonized System is an internationally standardized system of names and numbers to classify traded products. It came into effect in 1988 and has since been developed and maintained by the World Customs Organization (WCO).

In order to accurately calculate the customs Tax & Duty that needs to be applied to an item, the item must first be correctly classified under the Harmonized System (HS) with an HS Code. This can be done manually on a per item basis, but for the majority of merchants a manual approach is rarely a viable option. Instead most merchants will opt for automatic HS classification.

Customs clearance is the act of taking goods through the customs authority to facilitate the movement of cargo into a country (import) and outside the country (export).

All items being shipped to Europe from outside the European single market will need to go through customs clearance. If you don’t have the appropriate paperwork and approach this will cause delays to you and your customers.

(Not recommended)

DDU is the lightest touch approach from the merchant's perspective. It places the entire responsibility for paying customs tax and duty with the buyer. This option is not however generally advised if you want to provide the best customer experience to your buyer and you want to minimise international returns.

If you choose this option, your item will be held in customs on arrival in the destination country, an invoice will then be raised for any tax and duties and sent to your customer. When the customer pays, the item will be released. This approach however guarantees a delivery delay and in addition many customers are not expecting this additional charge, refuse to pay it and the item is then returned to you.

(Recommended)

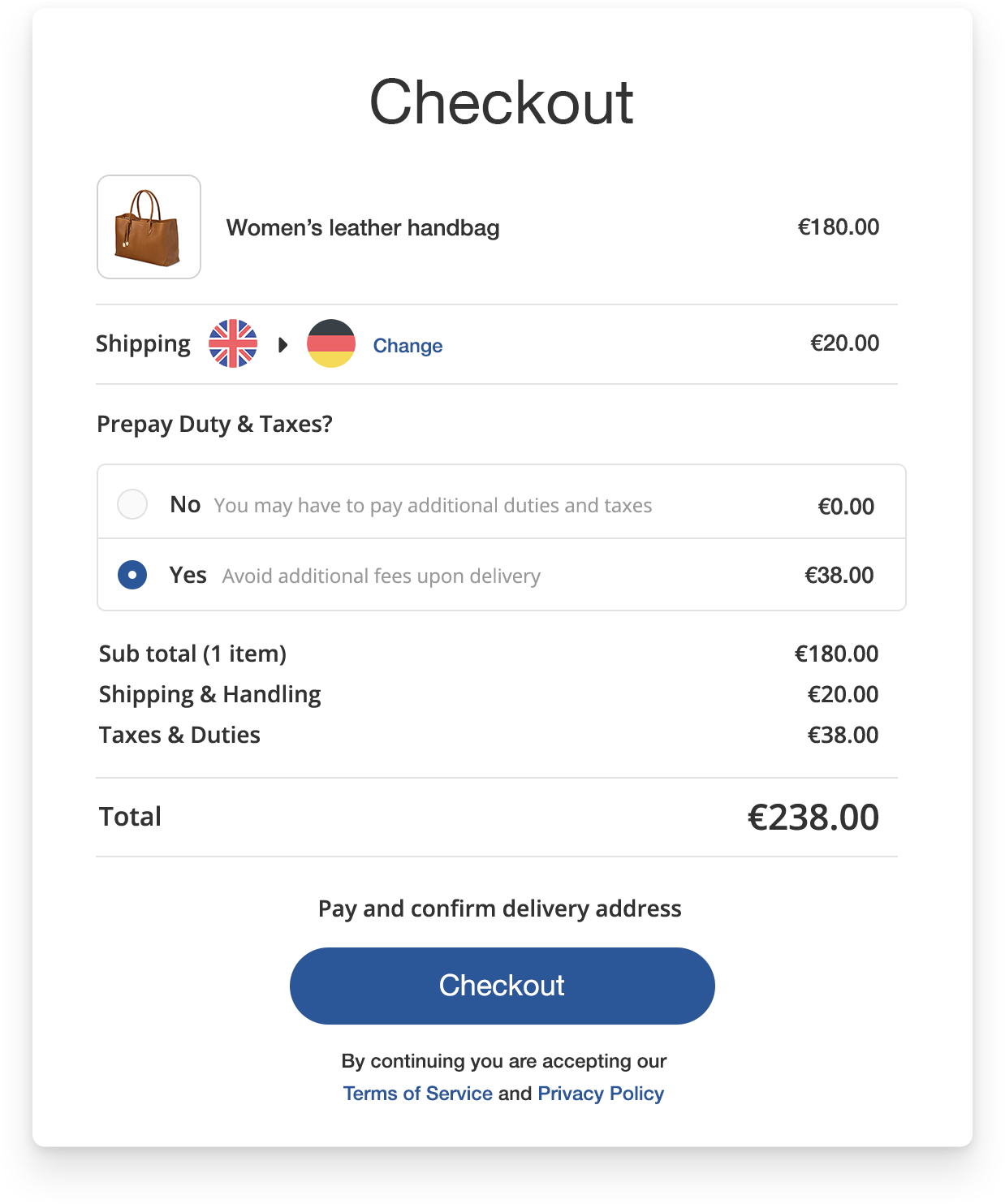

For the majority of merchants DDP is the recommended approach when shipping items to markets where customs tax and duties may be applied. With this approach the merchant will calculate customs charges for international buyers upfront and charge the buyer in the checkout.

This charge is then paid by the merchant to the courier and, so long as the item is accompanied by all the appropriate documentation, the item will pass through customs clearance and be delivered to the buyer with minimal delay. Taking this approach will give your buyer the best customer experience, will prevent them from receiving surprise charges and will ensure merchants minimise their international returns.

Whether you choose to ship your items DDU or DDP it is essential that all orders are accompanied by the correct customs documentation to ensure quick and efficient processing through customs clearance.

Your customs documentation will need to include:

We would recommend automating this process with documentation templates and checklists.

Reliability & Focus on customer service

The benchmark or objective to strive towards with international shipping is to endeavour to offer the customer an experience that is as close to their standard domestic shipping experience as possible. With international shipping there are clear challenges to fully achieving this. It will be difficult to, for example, provide a delivery time that is comparable to a buyer's domestic shipping time at the same time as offering a similar delivery cost. Some merchants achieve this through subsidising their international shipping costs and treating that subsidy as an international marketing cost or baking it into the item cost itself, this approach however isn't achievable for all merchants and all categories.

Fast service or Cheap service - offer both?

In an ideal world you would be able to achieve both, but inevitably that won’t always be achievable. If you’re not in a position to offer an international shipping service that is both fast and cheap, which most merchants are not, then the answer is to offer both a fast service and a cheap service. Merchants that offer multiple international shipping options see on average a 20% uplift in conversion rate at checkout. This is because with this approach you are able to appeal to multiple buyer types; the cost sensitive and the time sensitive buyers, with only one shipping option you’re likely to miss some of these buyers.

International transactions don’t end when a customer receives their order. European buyers must be provided with a compliant and easy to use returns process. Glopal's global returns solution ensures a streamlined system that is both easy for customers to navigate and affordable for merchants to manage.

Things to consider:

Recommendations: